Everyone talked about this already, so I’m late to the party.

Goldman

I want to make sure that anyone who missed it before catches it now: Matt Taibbi on Goldman’s profits. I’ve had a rough draft of an essay trying to walk through the government subsidies in their profits all week, and I can now delete it. Regardless of what you thought of his big Rolling Stone piece this piece is spot on.

Just saying, we warned you about this, that instead of being a driver of the recovery, deciding to “save” the banking system would just give everyone excuse to loot everything in site. As interfluidity said (my god do we need him back more than ever):

It is worth noting that overcoming coordination problems so that diverse parties can collaborate on profitable ventures is precisely what the financial sector is supposed to be good at doing. Ideally, we would like the profitable ventures to be welfare-improving projects in the real economy, but there is little question that financial sector actors will gladly apply the same skillset to extracting transfers and rents when the opportunity presents itself.

Check out this video of a French analyst losing it and saying what everyone knows is true.

CIT

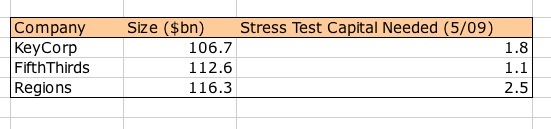

From the Fed’s stress test:

That’s risk-weighted assets. CIT is at ~$80bn, and from a latest stress test carried out by the government needs $4bn. (1) Any word on how that stress test was carried out? Was CIT able to use their own models on their own data, or did the Fed use theirs? Was it the same “adverse scenario” as the SCAP tests? If that data is public I’d like to see it. (2) If only CIT was another $40bn bigger, and carried more obvious counterparty risks, I don’t see how it would be much different that the banks above, who got into the stress test when the going was good. I bet if they could have used the stress test numbers back then, along with their own models, they could have engineered their losses under $2.5bn. I hope if one of those three banks above needs to go back to the government we let them fail – else it is going to be a leverage war to see who can get to $125bn the quickest (it may already be).

Technocratic Outrage

The Economist disagrees with the tone on the Goldman articles, quoting Krugman’s latest in the first sentence:

[Krugman says] What [Goldman] does is bad for America. Not “some of what it does is bad for America”. Not “the legal, profit-seeking behaviour of large investment banks may have some negative externalities that should be addressed by government regulators, in the following ways”.

This is no way to have a policy discussion.

Is there room for outrage? I always find this frustrating in economic technocratic talk, where outrage/disgust/shaming is dampened by having to focus in terms of “bad incentives.” There’s a schizophrenia in the way we talk about this, that capitalism on one hand is a benevolent invisible hand guiding us all together, and also amoral tiger who of course was going to rip your throat out if you don’t lock its cage properly.

Getting a little hyperbolic, it’s like someone has broken into our house and is looting everything in sight. How do we “set up his incentives” so that he leaves without the treasury in tow? Setting up the terms for discourse in economic rationality speak is only going to allow us to answer the question of “why didn’t we lock the door?” Good question, of course. But we have problems right now that rightfully deserve shock and anger. Couching it in terms of setting up good economic rules implies that government officials are like a Walrasian auctioneer, and we just have to get him to use the right rules – I think a genuine worry is that the auctioneer has been captured; not necessarily with bribery and conspiracies, but in that he (or his habitus) confuses the tiger for the benevolent hand.

Oh, The Economist.

Concerning “the right way to have a policy discussion” – I think the most dishonest aspect of this is that it ignores the point Krugman is making –that one side of that ‘discussion’ is not in good faith, and you can tell that by how they have acted, repeatedly, over time. You cannot have a policy discussion that assumes both sides have the same goals, if they don’t actually have the same goals. (I think our President should recognize this too).

All this discussion of tone is condescending and insulting on several fronts. The issue of shame is also important – the idea that no powerful economic actor should be ashamed of what they did, seems very clear from The Economist’s point. They aren’t as careful about not shaming poor individuals who make bad borrowing decisions, but apparently massive organizations that make bad lending decisions have nothing to be ashamed of.

Is it too naive to say that given the amount of uncertainty with respect to outcomes, and especially the disproportionate impact on those least able to withstand certain outcomes, shame and social opprobrium can be important signals and motivators?

And doesn’t this connect to the point you and someone else made earlier (can’t find the post now), about how the stock market itself had to be re-cast in the public mind and those of people who could invest in it, as “not gambling” in order for it to be socially acceptable. i.e. they had to eradicate the shame associated with gambling with other people’s money.

Absolutely agree on the capture. And just for a little counterfactual thought experiment, imagine that Hank Paulson both thought an AIG failure would be devastating and had no desire to prop up other firms.

There is absolutely no reason he could not have been waiting at the courthouse steps for the midnight bankruptcy filing to seize the domestic insurance business and the custodial business and told the claimants to AIGFP to pound sand.

If this really did cause Goldman to seize up and find itself unable to roll its repo financing – it wasn’t a bank yet – Paulson could have repeated the process, buying all of GS for $1 from the bankruptcy court.

This would have resulted in a quasi-government insured GS (and likely MS as well) and an AIG domestic lines business that was part of the US government. Does anyone seriously believe this would represent more risk to the Federal government? Meanwhile the government would have saved $180bn on AIG and would own the entire equity register of GS and MS.

Those hundreds of billions of dollars would go a long way towards funding a stimulus package.

Pingback: More on Goldman… « Beats and Pieces

“But we have problems right now that rightfully deserve shock and anger.”

Agree, agree, agree and agree. I read Megan McArdle tearing apart Taibbi and just groaned. She’s a smart lady, but I don’t think she gets it. Yeah, Taibbi is hyperbolic and a little off base here and there. But most Americans are in a collective coma about this financial crisis. They’ve already lost interest and wandered back to their HDTV. And what we know is that, with our political system, we cannot make the changes needed to our financial system unless Americans are angry and energized. Congress won’t do enough on its own. It really needs to feel the heat from the street — Main, that is.

Congress (and the rest of us) sometimes needs a 2×4 to the head to wake up. Taibbi is trying – remember the readership of Rolling Stone – have to be a little outrageous.

Krugman is trying to do the same thing to a different audience – the frogs in the kettle.

Ribbit

We need a good name for the new “line of business” that Goldman has used to make money lately. How about “Sovereign Policy Arbitrage”?