Gotta admit I’m not too pleased by the departure of Paul Volcker from Barack Obama’s circle of adviser. He was one of the few, along with Elizabeth Warren, in the current administration who had a proper perspective on the outrageous behavior that the financial community considers business as usual. And while the appointment of his replacement Jeffrey Immelt, of General Electric, signals a desire to snuggle up to the business community–at least Immelt comes from the manufacturing sector. He has experience actually making products, a skill notably lacking among every one of Obama’s other economic advisers.

Again, I’ll repeat: the important distinction here is between the business community, which should be encouraged to create more jobs, and the financial community, which should be shamed for its casino-gaming shenanigans and kept away from the inner circles of economic policy-making.

I agree with all that except the part about GE not being part of the casino-gaming shenanigans sector. That part, ummm, no. Before anything else, the idea that we have 15 million unemployed because of our “competitiveness” is just wrong, lacking any real substantial evidence. But the idea that GE can, as Joe Klein puts it, point a way forward from a financialized economy is also wrong. Two points.

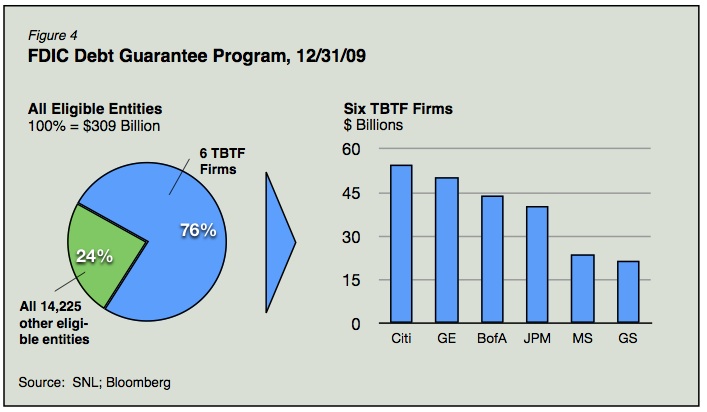

1. As Raj Date cleverly put it, to understand the bailouts, you need to understand “the Killer G’s”: Goldman Sachs, GMAC, and GE Capital.

GE Capital, the major subsidiary of GE, is a major shadow bank. It used GE’s high-quality credit rating to become a major player in the capital markets, much in the same way AIG FP used the boring insurance high credit rating. GE Capital was the single largest issuer of commercial paper going into the financial crisis.

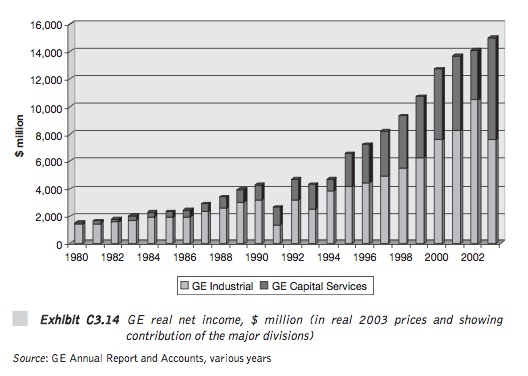

GE Capital received major bailouts during the crisis, including having the FDIC guarantee more than $50 billion dollars of unsecured debt that was issued. To put that in perspective, only about $24 billion of GE Capital’s funding comes through deposits, allowing a shadow bank with massive unsecured debt obligations and only a small depository base to be carried through the financial panic. Both graphs from Date:

2. Next I want to go to the book Financialization and Strategy: Narrative and Numbers (authors: Froud, Sukhdev, Leaver, Williams, 2006), which does an extensive case study of General Electric and the financialization of the manufacturing business model from 1980 onwards:

Our analysis of the undisclosed business model is relatively straightforward and focuses on seven principles of GE’s cost recovery under Welch:

1 run the industrial business for earnings;

2 add industrial services to cover hollowing out of the industrial base;

3 buy and sell companies through acquisition and divestment to achieve returns and

growth objectives;

4 rely on large-scale acquisition to prevent like-for-like comparisons and to increase

opacity and the power of narrative;

5 grow the financial-services business up to the limit of the company’s credit rating;

6 accept the balance-sheet costs in terms of return on capital but focus on managing

return on equity and cost of capital;

7 add financial engineering to smooth earnings and manage growth….The story of GE Capital is a story of upward mobility, as GE has found growth of sales revenue by moving beyond captive finance into many other lines of financial business. GE has sold financial services since the 1930s, starting with domestic credit for refrigerators, a classic form of captive finance. Up to the late 1970s, GE was arguably not so different from other US corporates, such as GM or Westinghouse, with a financial-services division whose central activity was captive finance. However, through the 1980s and 1990s, GE Capital greatly expanded and increased its offering in everything from LBO finance to store cards. GE has stayed away from retail banking and, after its problems with Kidder Peabody, moved out of securities dealing. But, in general, its expansion has been as a general supplier of consumer and commercial financial services, while also developing niche areas, such as mortgage insurance. The company’s expansion into financial services is neatly summarized by Fortune: ‘GE Capital pours wealth into the corporate coffers by doing just about everything you can do with money except print it’ (21 February 1994). Hence, GECS overtook General Motors Acceptance Corp. (GMAC) in terms of total assets in 1993 and was twice as large by 1997 (Forbes, 21 April 1997)….

In all this, the GE Capital board was engaged in high-stakes risk management where misjudgements about a class of business would have undermined GE’s financial record. By way of contrast, Westinghouse, GE’s conglomerate rival, had its finance arm liqui- dated by the parent company after losing almost $1 billion in bad property loans in 1990 (The Economist, 30 April 1994). GE Capital’s expertise in making acquisitions is acknowledged by S&P as one of the factors that supports its triple-A rating: ‘GECC (GE Capital Corp.) tends to be a very savvy buyer, understanding the various business risks and pricing the acquisition appropriately’ (S&P 2002: 2).

If the expansion of GE Capital rested on judgement and controls, it also reflected the structural advantage of the triple-A credit rating, which effectively made the financial business (as user of the credit rating) dependent on the industrial business (as credit-rating generator), and this in turn set limits on how much GE could expand without risking reclassification by credit-rating agencies. GE Industrial may be a low-growth business but it has high margins, is consistently profitable over the cycle and has funded almost all of the dividends that GE Consolidated has paid out, as well as providing the funds for acquisitions and repayment of debt. This solid industrial base is the basis for GE’s triple- A credit rating, which allows GE Capital to borrow cheaply the large sums of money that it lends on to consumers and commercial customers…

If there’s demand, we can dig into the huge debate in the analyst community about what was going on with GE and earnings management, a worry that hit an explosive moment post-Enron and Worldcom, during the Sarbannes-Oxley debates.

GE has been at the forefront of blurring a “financial services”-centric model of business onto the remains of a hollowed out manufacturing base, one kept in a minimal state just strong enough to qualify for high credit scoring. Marcy Wheeler has written about how that manufacturing part of the company is driven by outsourcing. In his recent, excellent book Cornered, Barry Lynn talks about how GE’s manufacturing business model becomes focus on business lines with government buyers (defense) and with government regulators and industry standard setters that can be worked (health care). They use the ratings agencies to only look at those business lines when determining the ratings they get, and lever up in the shadow banking network off that. Success!

This is not a big win for the notion of Jobs and Competitiveness.

I became a fan of Volcker only recently, not during his stay at the Fed. Considering what Greenspan did, perhaps I should have been.

Anyway, he seems to be one of the few (the only?) big players that gets the danger of too big to fail. Even if his political sucess in getting that into the finance reform bill was very limited, at least it was considered. Now he’s gone, replaced by yet another player from big finance. So there no small business, no union, no economics professors, or anybody out there to give advice on this disaster of an economy but another big finance guy.

Is anybody out there still trying to say that Obama is a socialist? (other than wing-nuts)

“GE Capital received major bailouts during the crisis, including having the FDIC guarantee more than $50 billion dollars of unsecured debt that was issued”

It’s pretty amazing how no one in the political sphere ever talks about that.

I’d say that GE’s savvy investment in MSNBC has paid major dividends for the company’s position.

“GE has been at the forefront of blurring a “financial services”-centric model of business onto the remains of a hollowed out manufacturing base”

Back when Matt Taibbi was writing his “vampire squid” piece on Goldman, I was sorry that he hadn’t taken on GE instead. They are in up to their elbows in defense, in healthcare, and in financial services. And they have it backed up with a huge media megaphone that they use to influence government policy.

The first rule of Washington Club is that you don’t talk about GE.

During the Welch-Immelt era, GE has been a great vampire squid wrapped around the face of the federal government, relentlessly jamming its blood funnel into anything that smells like money…

I mean, seriously. YMMV, but from where I sit:

CNBC literally birthed the tea party movement.

MSNBC was probably more responsible for Obama’s nomination than Ted Kennedy.

When you’ve got a chokehold on both parties, you don’t even have to care who wins the elections.

Going forward, it’ll be interesting to see if the deal with Comcast leaves GE with the total editorial control over political and financial news they’ve been using to great effect over the past fifteen years.

CNBC didn’t birth the Teahadists, but it was the first corporate media outlet to give them oxygen.

Going forward, it’ll be interesting to see if the deal with Comcast leaves GE with the total editorial control over political and financial news they’ve been using to great effect over the past fifteen years.

GE is going to want something different from GE? They both want the same thing, really.

Noted without further comment:

Olbermann departs GE on the same day that Immelt is appointed…

“If there’s demand, we can dig into the huge debate in the analyst community about what was going on with GE and earnings management, a worry that hit an explosive moment post-Enron and Worldcom, during the Sarbannes-Oxley debates.”

Yes please.

If the Joe Klein’s of the world don’t get that GE is just another TBTF, then it needs to be spelled out.

Also, wasn’t there a similar discussion around the time when everyone started looking at how OCC missed AIG, given that, at that point (when GE was getting all that TBTF $$), it was considered the next big threat?

As usual, you have it backwards. Volcker, despite his amazing inauguration as a Progressive Folk Hero, was a financialist. Immelt has, since 2008 been strongly advocating industrial policy and manufacturing. The problem with a simplified goodies and baddies script is that it makes you an easy mark for manipulation and self-delusion. Volcker, more than anyone, is responsible for the destruction of American manufacturing during his tenure as Fed President under Carter and Reagan – not to mention his culpability in the impoverishment of Latin America by US banks. GE’s financialization strategy came under the disgusting Jack Welch and if you have the research skills to look up his 2008 letter to GE investors, you will see a remarkable reversal of strategy under Immelt.

rootless_e,

GE bought WMC Mortgage in 2004, so this is hardly a Welch-only thing.

It does not surprise me that in 2008, as the capital markets were imploding, GE was going to have to retool their strategy, and market the hell out of that retooling. We’ll see how it goes.

I think Volcker’s been very good on post-crash financial reform debate. I’m not a with-progressives-or-against-progressives type; I pick and choose allies battle by battle.

I’m not touting Immelt as a virtuous person or even as consistent, but as of this moment, Immelt is a strong advocate of manufacturing and Volcker, whatever his other strong points, is entirely a creature of finance. Putting the CEO of the nations iconic manufacturing company on your team at a time that the CEO is “marketing the hell” out of a build it here theory is a positive indication, not a negative one. If Obama had done something like put Robert Reich, still an advocate (and a well paid one) of the “service economy” in the WH would have been something I’m sure our progressivists would have cheered, but that would have been a bad move.

GE has recently received substantial criticism for its commitment to sell its aircraft control systems software to a Chinese company in order to enter the Chinese market. Critics cite examples of other companies that have later been cast aside by their Chinese ‘partners’ when the knowledge base has been appropriated. http://www.democracynow.org/2011/1/20/has_obama_assumed_the_position_of

Pingback: Obama Capitulation Complete: GE CEO Replaces Volcker - CBS MoneyWatch.com

Pingback: Buzz Tracker - NYTimes.com

Pingback: Obama Swings For Jobs, Misses | Chicago Policy Review

Pingback: Obama's Corporate Makeover - NYTimes.com

Pingback: Links 1/22/11 « naked capitalism

” In his recent, excellent book Cornered, Barry Lynn talks about how GE’s manufacturing business model becomes focus on business lines with government buyers (defense) and with government regulators and industry standard setters that can be worked (health care). They use the ratings agencies to only look at those business lines when determining the ratings they get, and lever up in the shadow banking network off that. Success!”

I haven’t read Lynn’s book yet, but I found this nice quote from Woodrow Wilson in Thomas Frank’s review review of the book:

It’s been obvious over the past couple of years that we’ve gone far enough through the looking glass that we need to start reviewing the history of the Keynes v Central Bankers debates.

What may be less obvious is that we need to start reviewing pre-WWI economic history as well, to see the debates of how the initial progressive reforms were achieved, as well as how things got so far out of balance.

Fannie built the banking system to its current size, starting in the 30s. Court ordered entity breakups don’t work. Business structure is really no business of a court. Antitrust law is a deeply important principle to this nation, the long term consequences of which were ignored back when FDR set Fannie up to be a bank development program and shuttle bank loans off banks’ books in a perpetual motion machine. This retarded the growth of any system of many competitive lenders. But antitrust law enforcement is at best a clumsy tool, mostly only a nice racket for antitrust lawyers to make out for themselves by exercising their own sort of “stat arb.” Computers are at the root of change. The laws themselves are very clear: full disclosure, highest ethics, sophisticated or liquid exchange traded market pricing, in the sale of any security. Which is what securitized debt is. It can’t be government guaranteed. Period. The market of smarties (and that is NOT Uncle Sam) has to inspect this up the wazoo, and price it accurately and buy it or turn up their nose. No more Uncle Sam guarantee premium — yet another pure gift to banks to rifle the taxpayers’ pocket — for any of that crap!

“If there are men in this country big enough to own the country, they will own it.” And the way that they will own it is by continuing to finance senators and congressmen in their election campaigns. The only way to puta stop to this is to prevent anyone from running for re_election. This will need to be done by an amendment to the Constitution. Elect senators for a 12 year term and congressmen for 8. Then find yourself a new job. (prqbably as a lobbyist,but so be it.)

“The only way to puta stop to this is to prevent anyone from running for re_election.”

States that have implemented term limits in their state legislatures tend to find it resulting in more lobbyist influence, not less…

This discussion in a nutshell shows the poverty of “progressive” analysis. Unlike Robert Reich, still a “progressive” hero, Immelt has changed his mind about the service economy and become a huge supporter of industrial policy and restarting US manufacturing.

Pingback: Obama Capitulation Complete: GE CEO Replaces Volcker Gudumami.net

The “progressive” or left punditocracy has, unfortunately, bent to the peer pressure of the larger media and too often substituted narrative for reporting and analysis. President Obama just appointed GE’s CEO Jeff Immelt as the chair of his outside council of economic advisers with a mandate to focus on jobs and manufacturing. Progressive commentators who have previously demonstrated little interest in manufacturing condemned this appointment in the most peculiar way.

http://www.thepeoplesview.net/2011/01/left-pundits-kubuki-analysis-gets.html

Pingback: Manufacturing Debt

Pingback: Michael Hudson on GE Capital, WMC and Fraud | Rortybomb