I had a number of interesting conversations over the weekend about housing derivatives. People have reminded me that are plenty of derivatives that trade without being able to purchase the underlying, an obvious one being weather derivatives. Provided there is enough liquidity, people can hedge (or synthetically hedge) within the futures market itself. But the issue then changes to whether or not we can get enough liquidity – and I don’t see enough people wanting to get on the other side of the housing market at any time to get liquidity going.

And I had no idea Shiller has revived his Microshares see-saw idea to try and sell these derivatives. It’s based on the same terrible leveraged ETF design as his crude oil ETF, the one that imploded last year in a display the Wall Street Journal called “This fizzle, after a year-and-a-half run, is one of the highest-profile embarrassments for the growing ETF industry over the past year. Turns out the funds, the brainchild of famed Yale economist Robert Shiller, were too smart for their own good.” (The WSJ piece is a good overview.) Good luck with this the second time around; nice 1.25% expense ratio on the fund (can you call it a fund if you hold leveraged T-bills instead of the underlying?).

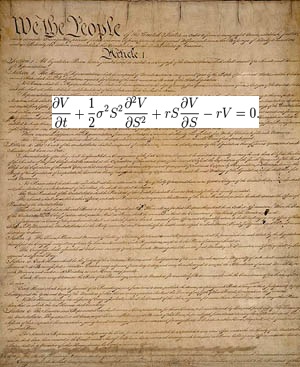

Constitutional Financial Innovation

I’m going to read one level into Shiller’s argument and note that, at the end of the day, he’s concerned that average Americans need better tools to manage the risks of their incomes and investments. I think Reihan Salam and other smart neoliberals has flirted with this idea of derivatives designed for the middle-class to help them deal with risk management in a post-Risk-Shift world. The idea that consumers could buy put options on themselves – options that are more valuable the worse things get, that can provide a floor under which losses could not go – to help them manage the downside risks they face in volatile assets and increasingly uncertain labor markets, would be a huge innovation if we could pull it off. But in the same way that nobody would naturally want to insure the housing market, I can’t see enough people wanting to insure the middle class to get instruments like this to start.

Here’s something that should make conservatives happy. The best, and I mean the best, put option contract for consumers ever conceived, is written right into The Constitution: “To establish…uniform Laws on the subject of Bankruptcies throughout the United States.” Yes, viewing bankruptcy as a financial engineer does, as a put option on assets and volatility for consumers, handles all of this risk management in a way that is cleaner and more efficient than any derivatives market foreseeable in the future.

Bankruptcy As a Put Option

Shiller is worried that we don’t have a way for a household to write a put options on its assets. For a simple example, let’s say a household has a house worth $500k (assets), and a debt worth $400k (liabilities), and there’s a very high probability that it can make the payments on those liabilities.

People like Shiller wants you to be able to pay a small fee so that if the asset is suddenly worth $300K you get $100K in value – the put option is presumably written at the level of liabilities. He also wants you to be able to hedge income, so that if the probability of you being able to make the payments decreases – long unemployment spells, health problems, etc. – you can get a payout that would reduce the liability to the point where the house can manage them.

Notice that if the household goes bankrupt, because assets are less than liabilities, liabilities are marked down accordingly, directly as if a put option has been exercised. In an ideal bankruptcy, it would be marked down that $100K in the example above, or marked down to the point were payments have decreased so they are manageable.

Taboo Talk

I know it is taboo to talk about it this way, since bankruptcies are nasty zero-sum games evil people do but put options are wonderful gee-whiz innovations that are in no way zero-sum, but I honestly don’t see a net difference between a household declaring bankruptcy and a household collecting money on a put options it has written on itself. You are being charged for credit risk by the people who lend to you; you are already paying the fee for having this put option.

If anything, bankruptcy handles the moral hazard problem better with these “insurance” like contracts and it is held by the debt lender, so the cost of the option (how much extra you are charged to compensate for credit risk) can be individualized in a way a commodity market couldn’t handle. Sure lawyers collect a fee for pushing people into bankruptcies, but I have a hard time believing it’s any worse than a 1.25% expense ratio the derivative sellers are getting. And key is that it is only exercised if the household can’t manage the liability payments – someone has to pay me, zero-sum, if my house declines in value even if I can make the original payments on liabilities with this hypothetical put option. Someone only has to ‘pay me’ in bankruptcy if I can’t manage the payments – in this case, I hold this risk longer as long as it is optimal for me to do so.

I need to flesh this out more, and I’m interested in the minute differences between the two in equilibrium. But the last time I checked, we are currently trying to dismantle this financial innovation as it is part of the neoliberal vision of governance to dismantle and then privatize the social safety net, regardless of whether or not a functioning market is in place and how well the social safety net provided. If anything we should be expanding this – mortgage cramdowns would have been the financial innovation needed to survive the foreclosures and raw neighborhood destruction that is going to characterize 2010.

Bravo!

I liked your taboo thinking on bankruptcy. My taboo thinking is that all debt based on a personal guarantee is questionable. Mortgages in no-recourse states are an example of debt not personally guaranteed b/c they’re guaranteed only by the collateral. Another example would be a loan to large business collateralized by the business with no individual personally signing for it.

The purpose of loans is to allocate capital to worthy projects. If I want to start a business, I could get a loan. But typically I would be required to sign personally for the note. In that case, I should just use my own money, since the bank will get my money anyway if the business fails. It’s a confused arrangement when the bank looks at my business plan but also looks at my personal ability to pay even if the business plan fails. We think of it as a loan against the business, but it’s also a loan against my future ability to earn money doing something. This part of the loan is not an example of the bank allocating capital to worthy projects.

Consumer debt is even more useless to society. It just lets people buy stuff before they have the money. It’s secured by the consumer’s ability to earn in the future. This arrangement is bound to have problems, so banks have a system of credit reporting and society has a system of courts to collect the debts and bankruptcy to protect people from collection judgments that take money they need to provide for their basic needs. If we only used debt secured by insurable collateral (price insurance may include puts) and by large organizations, the whole problem of bankruptcy would go away. The downside is people would have to wait to save up money, but once that happens the economy goes forward without banks taking a cut of people’s consumption.

1) Allowing someone to make a bet on their own loss is /incredibly/ dangerous.

2) Bankruptcy also handles recalculation very, very quickly, and allows for very quick de-leveraging throughout a market. I think if the large firms had declared bankruptcy, and the chain of contagion had worked its way through the market normally without bailouts, we would already be out of the recession, in large part because a chain of bankruptcy is very, very quick de-leveraging. More pain for a few months, a lot less pain over the next few years.

Along these same lines, Asset Value Models, aka Structural Credit risk Models or Merton Models, treat bankruptcy as a put option in order to estimate counterparty default frequency.

Essentially, using enterprise value, liabilities and the volatility of enterprise value one may estimate the value of the bankruptcy put option implied, and therefore the likelihood that a company will exercise said option. Such models have been around for quite some time. KMV is probably the industry leader, though other companies like FirstKnowIt.com offer similar products.

Pingback: Assorted Links (10/5/2009) – Jim Garven's Blog

I had an idea years ago about an employment futures contract but I never got around to making a model for it, maybe it’s time to dust it off. I had another idea to put return deposits on all goods to insure recycling.

I think I discussed this in the car with my father … in 1970 or thereabouts … he thought these were great ideas.

Good Ol’ dAd.

There is a substantial difference between bankruptcy and a put option on housing. Namely, bankruptcy is binary, and a put option is not. If you have liabilities of 400K, you can write a put option with a strike price of 450K. That allows you to preserve some assets at a somewhat greater cost. Bankruptcy doesn’t do that. You either declare or you don’t.

This distinction has potentially huge implications, both for the bank and for the homeowner. I’m not saying that put options on real estate are feasible to create, but bankruptcy is a general substitute. Put another way, bankruptcy can be viewed as a put option. But not all put options are bankruptcy.

Chris,

I LOVE me some Merton Model of credit risk. Here’s me talking about inequality and the risks of the middle class using the Merton Model as a theoretical guide:

Yay. Good times.

but I honestly don’t see a net difference between a household declaring bankruptcy and a household collecting money on a put options it has written on itself

I guess the difference is that we are all placed under a bankruptcy regime which our lenders implicitly accept, whereas a put option is optional. If we eliminated bankruptcy we’d have to option of going without it and so some lending that wouldn’t previously have occurred (because lenders fear the borrower would go bankrupt) will.

“If we eliminated bankruptcy we’d have to option of going without it and so some lending that wouldn’t previously have occurred (because lenders fear the borrower would go bankrupt) will.”

Just because bankruptcy protection is gone doesn’t mean that people who would otherwise have defaulted will magically be able to pay their debts. Lenders would still need to be diligent about a borrower’s ability to pay. Ultimately, lender’s don’t fear bankruptcy specifically: they fear that the borrower won’t pay them back.

People have reminded me that are plenty of derivatives that trade without being able to purchase the underlying, an obvious one being weather derivatives.

… on which you can purchase instruments very close to the underlying. The heating indices are hedged in the fuel oil and electric power markets, while the hurricane indices are hedged by buying and selling reinsurance.