I saw an ad on craigslist (though most story that starts with that line are shady, this one is not especially so) for apartment rental opportunities in Sacramento, CA. The rent was very cheap, but you had to post a gigantic security deposit, sign away rights related to eviction and give proof that you’ve never been convicted of a crime. Digging a bit deeper, it was clear that the owner was an out of state company that was buying up sections of foreclosed homes in abandoned neighborhoods. And what they needed was less a “renter” but a controlled “squatter.” If left alone, these buildings would become homes for the homeless, gang activity, looters and pranksters, etc. So what the investment company wanted to do, since they wanted to sell the properties as homes in the long run but couldn’t in the short run, was get someone to squat in these buildings for them; they were looking to hire a respectable squatter, get him on the payroll through really cheap rent, and he or she who could do whatever in the building as long as it wasn’t destructive of value.

I think that’s a good metaphor for what homeownership is like with a regime of subprime loans. I like discussing this because it blurs the line of the ideals of homeownership of the late 20th century – a yeoman ownership society where nobody ever washes a rented car – with something more feudal. We’ve had this discussion before, but it only focused on the way up – what’s interesting now is we can begin to play with a theory of fake homeownership on the way down. But to recap:

On The Way Up

Here’s what fake homeownership looks like on the way up. Here’s me making this argument in greater detail with lots of numbers and their sources, but here it is condensed: a subprime loan’s “teaser rate”, the initial rate, was much higher than the prime rate. It was often in the 8-9% range. So the teaser is set at the maximum level a borrower could pay, and there’s an interest rate jump at the 2 or 3 year mark. It is highly unlikely the borrower can make the jump payment, so they must refinance it. In fact, you see something like 80% of subprime mortgages refinanced by the 3 year mark.

What is often not discussed is that over 70% of subprime loans have a prepayment penalty. The prepayment penalty is quoted in terms of months of interest (BS like that is reason alone to have vanilla contracts), and a rule of thumb is something like 6 months interest which at the 2nd or 3rd year is somewhere about 4% of the principal. Now the subprime borrower probably doesn’t have 4% of the principal laying around, so it is rolled into the new principal of the refinanced loan.

This is influenced by the binomial approach Yale economist Gary Gorton takes in his The Panic of 2007 paper (see around page 15 if you are a finance geek). Note that this contract is rational only if housing prices are expected to appreciate faster than the fees, and on average analysts thought housing prices would go up about 5% a year. So the endless recycling of these loans generates fees that eat up a large chunk of the house price appreciation. No wonder all these homes are underwater!

What Gorton puts weight on in his model is that banks can choose not to refinance, and the homeowner will likely have to sell the house – so there’s an option embedded for a foreclosure after two years by the bank (he argues that refinancing with other institutions is difficult because of the adverse selection issue). So from a financial engineering point of view, the bank has hired someone to sit in a house for them, and they are each getting paid by splitting the home equity. The borrowers need to be of poor quality else they’d just gamble on HPA with a prime mortgage.

Julia Gordon, of the Center for Responsible Lending included a similar narrative in her written remarks for the FCIC (pdf, pages 8-9).

On The Way Down

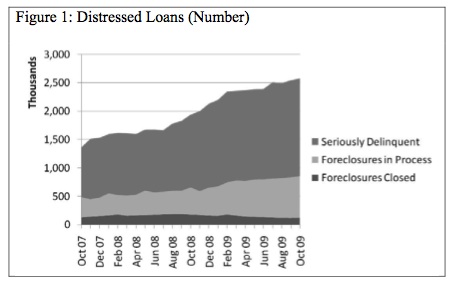

Here’s what fake homeownership looks like on the way down. I didn’t talk enough about this graph:

The report, Analysis of Mortgage Servicing Performance (pdf) finds that:

The number of loans in the process of foreclosure has increased substantially over the past year. The total number of loans in the process of foreclosure increased by 52% (252,000 loans) between October 2008 and October 2009.

This increase appears to be driven by prime loans….

While the number of loans in the process of foreclosure has increased, the number of foreclosures completed has fallen 31% in the past year. We believe this phenomenon is due to a combination of backlogs in the foreclosure process itself, a desire by servicers and investors to avoid accumulating even more REO property, and temporary stays of foreclosure sales due to related loss mitigation activity.

If you read further, it’s clear that the temporary stays of foreclosure are negligible. Here’s Felix Salmon on this:

The key thing to note here is the bottom, darkest line: while delinquencies and initiated foreclosures have been rising, there’s a limit to how many foreclosures can actually be completed, and that limit seems if anything to be falling.

What this says to me is that while we aren’t going to see a wave of foreclosures, we are going to see a large and more or less constant number of foreclosures for the foreseeable future — with all the gratuitous value destruction that implies.

Indeed. Daniel Indiviglio has written about the shadow foreclosure inventory, and this slow backlog of inventory is going to be an albatross on both the growth of the real economy and the ability of everyday Americans to grow wealth and savings. This is a widespread phenomenon – the rate of prime loans failing is doubling at all times. One solution would be large principal reductions. Another would be to allow for mortgage cramdowns, to make neogiations more credible. Another would be to subsidize short sales. Another would be to have the government purchase a huge chunk of these mortgages at a cheap price and sit through whatever profit can be made – Roosevelt’s efforts to do this in the Great Depression made a profit.

But it is fascinating to think of what is happening with the people who can’t make their mortgage payments but haven’t been foreclosed on. The bank in this case is exercising an option to defer foreclosure – an option I never thought would be used on such a wide-scale. How does that option work? And what kind of ‘ownership’ do people in these situation experience? Is it a kind of mini-vacation, where you get to live in a nicer house than you could ever afford? Is it a perpetual sense of anxiety, where someone could come to remove you within a week? Is it just a sense of resignation at being a widget that the largest banks are using to pretend second-liens assets are worth something other than a penny on the dollar – their home as juking some financial statistics? I’d love to read more about that.

Fake homeownership is just another ploy in the complex game of rent-seeking that FIRE plays to extract wealth continuously from the middle class.

In my view this is a classic extend & pretend policy: banks delay recognizing losses in order to appear solvent and profitable, “smoothing” loan loss reserves over a long period of time.

This is exactly what I learned about the Japanese crisis in my very first economics class. Zombie banks with devastated balance sheets staying alive for up to a decade. The lesson has been forgotten.

I think that’s a good metaphor for what homeownership is like with a regime of subprime loans. I like discussing this because it blurs the line of the ideals of homeownership of the late 20th century – a yeoman ownership society where nobody ever washes a rented car – with something more feudal.

When I read the first of those two sentences I answered, “what homeownership is like with a feudal model of land ownership centered on banks as the rentiers”, and then I read the second sentence.

Of course, this is an ongoing process of degradation and expropriation. More and more people will “own” less and less.

And what kind of ‘ownership’ do people in these situation experience? Is it a kind of mini-vacation, where you get to live in a nicer house than you could ever afford? Is it a perpetual sense of anxiety, where someone could come to remove you within a week? Is it just a sense of resignation at being a widget that the largest banks are using to pretend second-liens assets are worth something other than a penny on the dollar – their home as juking some financial statistics? I’d love to read more about that.

I guess that’s a matter of psychology, which the banks and the government try to manipulate through their propaganda campaigns, everything from the “American Dream” to “don’t walk away from underwater mortgages, that makes you an immoral deadbeat.”

Even as they reduce everyone to the most tenuous financial existence, as long as possible they want people to see themselves as “owners”, or at least as “responsible” stewards.

That is, they want us to feel the responsibilities of such status, but at the same time the fear and insecurity that it can be stripped away at any time.

In California a Notice of Trustee Sale would give the soon-to-be former owner about 20 days’ notice. Once the building was taken back by the lender, the owner could be served with a 3-days’ notice to vacate. Lenders have been doing this with condos for a couple of years. Since they don’t want to pay the condo association fees, they file a Notice of Default (the first step in the process) and then do nothing. The condo association is then stuck, since in foreclosure the first mortgage holder gets paid off first. Other lien holders are wiped out.

Call it the “other Greenspan put.” Cf.:

http://underbelly-buce.blogspot.com/2010/01/fake-home-ownerfship-and-other.html

“How does that option work? And what kind of ‘ownership’ do people in these situation experience? Is it a kind of mini-vacation, where you get to live in a nicer house than you could ever afford? Is it a perpetual sense of anxiety, where someone could come to remove you within a week? Is it just a sense of resignation at being a widget that the largest banks are using to pretend second-liens assets are worth something other than a penny on the dollar – their home as juking some financial statistics?”

This fits in with my own theory of the Housing Bubble, which is advanced by, me. People have become terrified of the possibility that they will be indigent in retirement, should that ever prove possible. They have little or no extra money to save. Hence, it is reasonable for them to try and save out of their current expenses. The way to do this is buy as opposed to rent. In theory, when you sell the house down the road of life, you will receive some of your payment money back. That, or live rent free, possibly lowering monthly expenses in retirement.

During the Last Bubble, this fear was wedded to the notion, in many people’s minds, that if you didn’t buy a house now, then you never would. It wasn’t so much that housing prices would never get lower, as that, if they did, it would be because interest rates went up. It was that you would never again be able to afford buying a house. Given this double fear, many people were willing to take the gamble, especially when the odds against them were fudged.

Only fear can explain much of the behavior of buyers in the bubble. That and unscrupulous people taking advantage of that fear. I know. I’m the only person who believes this.

It’s actually much worse than that. Subprime mortgages are designed in ways that do not allow home owners to build equity simply by making regular payments. The only way the mortgagor can get ahead is if house prices go up. It’s not a savings plan; it’s a gambling scheme.

Clearly the investment company has more to lose here than the potential “renter” so it would seem the squatter should be in a position to negotiate a far better deal

I enjoy your blog and think this an important topic. I live on the “Gold Coast” of CT with many large homes. My neighbor is in the situation you described with underwater mortgage and bank refuses to negotiate lower payments. They keep postponing foreclosure so neighbor has decided to live there without paying mortgage or taxes until evicted. There must be millions of these foreclosures in the pipeline.

Pingback: The Cost of a Foreclosure « Rortybomb

Pingback: Email from a reader, on not being foreclosed on. « Rortybomb

Pingback: A Mortgage in the State of Nature? » New Deal 2.0