I just found a short, must-read presentation on the shadow banks. But first:

I think the Volcker Rule is a good first step that I am excited about as it starts to get at the problem of shadow banks, but I am incredibly unhappy with the both the follow-through on it, and how it isn’t getting at the actual problems with overlapping business models creating ‘shadow banks’ subject to bank runs.

If you follow the finance blogs but aren’t necessarily in the deep end, you may not know what people are getting at when they say that the real problem is with how lending is done in the capital markets. Yves Smith gets it, and as bond girl pointed out “the old classifications used to mean something because banks were the locus of credit intermediation. Now that this function has largely shifted to the credit markets, through repos and securitization, for example, they are less relevant.”

Trying to get a working definition and a coherent explanation for journalists and laypeople of shadow banks and overlapping business models is something I’ve been trying to do for a while. It’s important because you need to see that relationship in order to get what works and what doesn’t with the Volcker Rule, and how it needs to be expanded. With the way Volcker and the administration are selling the reform, it looks like their mental model of the financial markets stopped in the 1970s – and it’s incredibly important, for a narrative of what broke and how to fix it, to see the way financial markets and lending have changed over the past 30 years.

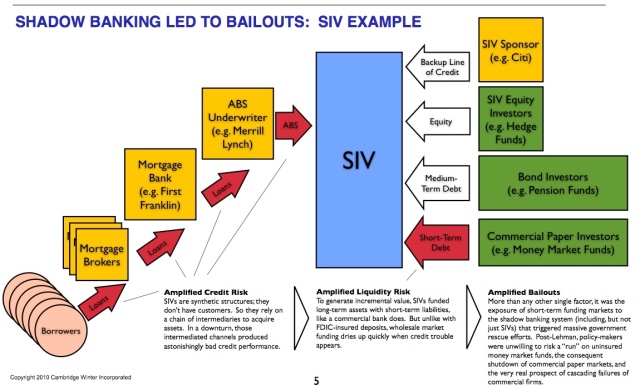

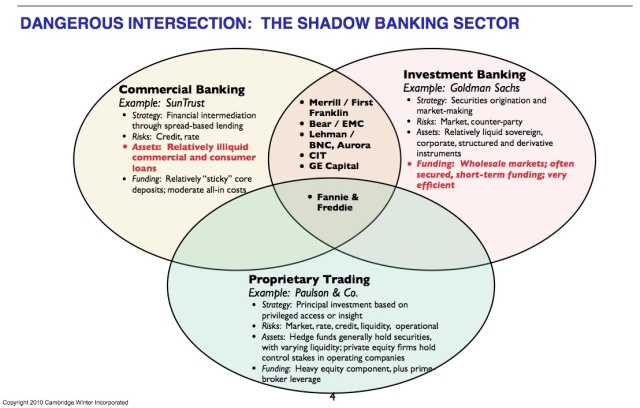

Luckily, someone just sent me this guide, Through the Looking Glass (Steagall): Banks, Broker Dealers, and the Volcker Rule, by Raj Date and from the recently opened Cambridge Winter Center for Financial Institutions Policy. This guy gets it. And this guide has my new favorite illustration of the financial markets – a roadmap to the shadow banks:

(Why didn’t I think to draw it out in overlapping circles!?) In red, you can see that there is a mismatch between the assets and the funding in the intersection between commercial banking and investment banking. From the short presentation:

Like the Glass-Steagall regulatory framework, the Volcker Rule focuses on the intersections between commercial banking, investment banking, and proprietary activities. Notably, each of those business models — in their “pure” forms — has a funding model that suits its asset risk profile. Commercial banks make relatively illiquid loans, but they have privileged access to relatively resilient core deposit funding. Investment banks hold inventories of relatively liquid securities, which enables them to use extremely efficient, short-term, low-cost funding (like the overnight “repo” markets).

Many of the credit bubbleʼs excesses can be traced to the “shadow banking” sector, which is essentially the

intersection between commercial banking and investment banking business models: shadow banks take

illiquid credit and interest rate risk (like commercial banks), but fund themselves principally through the

wholesale markets (like investment banks). Because of long-recognized regulatory loopholes, shadow banks

were also frequently able to operate with significantly lower capital requirements than commercial bank

competitors. With both capital and funding advantages in hand, shadow banks grew to some 60% of the U.S. credit system.To many investors and policy-makers during the bubble, shadow banking vehicles (like “SIVs”) appeared to

perform precisely the same functions as commercial banks, but were more efficient. Unfortunately, shadow

banks proved to be extraordinarily fragile; both the asset and liability components of their business models

suffered as the credit cycle turned. Unwilling to risk a shutdown in the short-term funding markets, central

banks and governments stepped in to prop up the shadow banking system.

And as such, the Volcker Rule is poorly targeted. Also from the presentation:

See that?

I rarely say this, but for anyone interested in financial markets this presentation is a must-read. The graphical approach works perfectly. Read it twice, then go back and read the interview I did with Perry Mehrling about shadow banks, or Ezra Klein’s write-ups (One and Two) of how a bank run in that overlapping space works, using that map as a guide.

Also, for fun, here’s why the financial system looked so efficient during the naughts, efficient in a way that made regulators want to sit back and let it work its wonders:

Mike, is this as simple as putting a firewall between everyday, utility-like commercial lending and everything else? Or is that impossible?

Rorty:

I agree that the Volker rule is a good idea. I also believe it does not go far enough. Certainly it would not prevent the crises we are currently in.

In your earlier Atlantic piece, you are correct in stating that, as the shadow banking system could not go to the discount window in extremis, it could experience a catastrophic run. You do not talk about how those firms almost certainly had negative equity, or if not negative equity, then equity that fell below their capital requirements. There really was more to this crises than liquidity. The firms are (were) insolvent.

You seem to be leaning towards “better securitization” and I’m curious as to your thoughts on securitization in general — does it have a point? If lower interest rates just drive up prices, then are borrowers any better off than before? Why bother with a shadow banking sector at all?

The US mortgage market is an excellent test case when thinking about this. Mortgage securitization did not begin in earnest until the 1970s, and I believe the US had sufficient stock of housing prior to that. Keeping loans on books also neatly solves the problem of how to make lenders care whether their loans are paid back or not. Something which I believe is central to the entire point of banking, and pertinent to the matter at hand.

Hi,

Whatever financial engineering (or whatevet one may want to call it) people come up to, there’s something basic : selling revenue must be higher than the money spent.

Like any other business, if banks/investors buy credit, financial products, etc without their own resources and if they invest in futures, they can lose it and still own money to the creditor. No one can predict the future.

Just a small word about hedging: lately people talk alot about hedge funds and how they went bust.

Well, hedging is not someting new and as a matter of fact, it’s a good thing.

The problem is that due to GREED, people don’t hedge but bet everything in the same horse and often bet into the horse that has less possibilities of winning.

Hedge funds were created, as far as I’m aware, with the intent of protecting investments from market falls.

Things like: if you have investments in stocks of a foreign currency ,you put some money aside betting on the lower value of the currency, so that in case it goes down, your shares will be worth less, but you’ll compensate with the warrant, CFD, forex, whatever.

If you buy shares from different companies, you can put like 3% in a warrant that will go up if the market goes down.

This is hedging.

Of course that there’s now 100% safe investment, but I can tell you three important things : never put your eggs in the same basket, don’t fall in love with a stock, don’t be greedy.

Ah ! Don’t rush making clumsy and dangerous investments to recover some money that you lost.

Have a nice wekend and stay cool,

José

That is a brilliant presentation. It’s amazing what can be conveyed with a single picture.

My first reaction to the Volcker Rule (well, after noting its timing) was that people had somehow already forgotten this was a wholesale bank run.

The solutions proposed in the presentation are great, but it is worth noting from a political standpoint that the repo market is being exempted deliberately from reform measures. Aside from not wanting to rock the boat further, the administration is likely finding that reform can potentially interfere with its own funding requirements and with Fed policies.

Bond Girl:

The problem of wholesale bank runs is trivial to fix — even Bernanke got there eventually, although he made a dogs dinner of it. Likewise, the problem of the US Federal Govt’s “funding” problem is trivial to fix as well.

I was looking for some discussion over what the real benefit of securitization is, as I’m not sure there is a fix for the for the repo/securitization sector. The standard answer, “lower interest rates”, seems insufficient as 1) if those lower rates just translate into higher prices, you get a transfer but not net, real improvement, and 2) risk was obviously mispriced, so the “lower” rates were bogus.

Pingback: Weekend Reading – Innovation Nation | Leigh Drogen

re: the first (top) Venn Diagram: all good, except that ‘commercial banks’ can lose BIG not only on credit and interest rate risk, but operational risk as well. For example national australia bank has traditionally had a very good credit, but came unstuck over the last decade with a variety of OpRisk stuff ups, eg Homeside in USA, misleading loan doc info in UK, etc

Pingback: FT Alphaville » Further reading

“Like the Glass-Steagall regulatory framework, the Volcker Rule focuses on the intersections between commercial banking, investment banking, and proprietary activities. Notably, each of those business models — in their “pure” forms — has a funding model that suits its asset risk profile.”

Here’s how to implement that goal:

“What about investment banks, brokerage firms, hedge funds, and insurance companies? What’s their right financial order?

Again, regulate to purpose. Investment banks take companies public and assist in mergers and acquisitions. They shouldn’t be permitted to invest in their clients’ companies. Brokerage firms are here to help us buy and sell assets, not to gamble on spreads. Hedge funds are here to help limit risk exposure. They aren’t here to insure these risks themselves. Finally, insurance companies are here to diversify risk, not write insurance against aggregate shocks.”

http://blogs.ft.com/economistsforum/2009/01/putting-an-end-to-financial-crises/

Totally off topic, how do you get neat graphics from PDFs onto your blog?

Please read the Kotlikoff, because, like Jack Burton:

“Jack Burton: I don’t get this at all. I thought Lo Pan…

Lo Pan: Shut up, Mr. Burton! You are not brought upon this world to get it!”

I wasn’t brought upon this world to get it.

I will check it out Don. And I use the program “grab” that comes with my mac to take a screenshot of the pdf, and then I turn that into a jpg using preview.

Do you notice that the mer/leh/Bear entities within the red dotted oval labeled ‘the biggest problem no longer exist?

CIT/GS/GE capital are now technically Banks

AS a result I think the Red dotted oval labeled the volcker plan expands and shifts up and to the right into the inetsecting ovals to include GS/CIT/GE +MS. I’m ducking, because I know I hold a minority view that the VPlan subjects these entities to the similar restictions he proposes for CBs, namely intrusive regulation, increased capital requirements, & size and liquidity constraints.

The SIVs / shadow banks which fed the LEH/Bear/AIG were a problem because they escaped oversight as a result of arbing Accounting rules that enabled them to maintain the fiction they were not banks. That loophole has effectively been closed as SIVs are now housed within banks.

No matter how you slice it capital market debt funding is going to become more expensive and regulated. Sutrely a balance can be struck where capital charges for debt properly rated does not destroy the debt capital markets. In the absence of crap AAA, its hard to imagine this business can’t be conducted by the banks. It will surely be less proftable to them, but not unprofitable. A balance can be struck.

Sorry This should read

In the absence of crap AAA, its hard to imagine this business can’t be conducted by (the banks-strike this) the regulated capital markets institutions proposed in the V Rule