h/t nakedcapitalism, Josh Rosner on one way in which the foreclosure fraud crisis could go systemic:

Nearly all Pooling and Servicing Agreements require that “On the Closing Date, the Purchaser will assign to the Trustee pursuant to the Pooling and Servicing Agreement all of its right, title and interest in and to the Mortgage Loans and its rights under this Agreement (to the extent set forth in Section 15), and the Trustee shall succeed to such right, title and interest in and to the Mortgage Loans and the Purchaser’s rights under this Agreement (to the extent set forth in Section 15)”. Also, an Assignment of Mortgage must accompany each note and this almost never happen.

We believe nearly every single loan transferred was transferred to the Trust in “blank” name. That is to say the actual loans were apparently not, as of either the cut-off or closing dates, assigned to the Trust as required by the PSA.

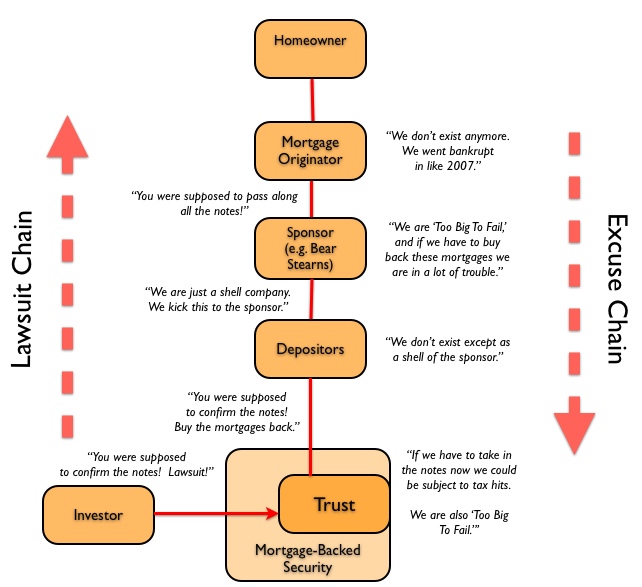

Rather than continue to fight for the “put-back” of individual loans the investors may be able to sue for and argue that the “true sale” was never achieved. To think of it simply, if you go to sell your car and you endorse your title but neither you nor the party you are selling it to sign their name who owns the car? It appears you likely still do.

While there may be a view that the government can intervene it appears that the private contract spelling out the terms was violated at the transfer point. The Trustee, who has responsibility to make sure all loans were properly assigned to the trust, may have liability. So too might the lawyers who issued the legal opinions.

This is different that haggling over the buying back of individual mortgages, which would likely never blow up. This is arguing that the sale of the mortgage, the “true sale”, never happened. So in addition to the uncertainty and delayed processes from the current fraud, we now have a small percent chance that we could see a Lehman Brothers style weekend. Tail risk being generated weeks before a very rough midterm election. Oh boy.

In addition, Adam Levitin’s Citi comments have been summarized by Citi in this pdf. It’s full of systemic risk fun. Excerpt:

Issues Concerning MERS

MERS (Mortgage Electronic Registration Systems) functions as a centralized electronic registry of mortgages and tracks ownership of mortgages. MERS allows mortgage ownership to change hands efficiently and relatively quickly since it is electronic and allows all parties to forgo making a filing in local land records. Indeed, MERS was designed to function as a substitute for local land records.

Although MERS was designed to enhance efficiency in the mortgage assignment process, Levitin argued it may not conform with the law. “Slowly but surely” courts are issuing decisions which “cast validity on the MERS process.” Although ~60% of mortgages list MERS as the “nominee” which owns the mortgage, a handful of recent court cases have ruled that MERS has no standing in foreclosure actions either because (1) physical paperwork must be transferred when a mortgage is assigned by one party to another or (2) MERS has no true economic interest in the mortgage in question since it collects no payments from the borrowers.

We’ll start talking more about MERS shortly. There’s a lot more in the pdf. All the more reason for the government to get in front of this one and for blogs to continue to outline the stress points and start debating solutions.

Got my beer and chips at hand. Gonna grab my comfy chair and watch the firewirks.

Weeeeeeee!