Remember this guy? David Walker of the Peterson Institute gets nostalgic about debtors prisons for strategic defaulters.

There is a norm asymmetry being ruthlessly exploited between how people and businesses view debt. Strategic default is not a phenomenon in any empirical data, but it is a boogeyman that needs to be ruthlessly pounded on before people realize that bankruptcy is something they pay for in their mortgages, and it is their ultimate safeguard against abusive practices. It’s telling to watch financial elites freak out about the prospect of strategic defaults waves, even as they don’t happen. It shows what really worries them about the state of the economy, about where they may not have control.

A Multi-Year Foreclosure Pipeline Slowdown Slows Down More

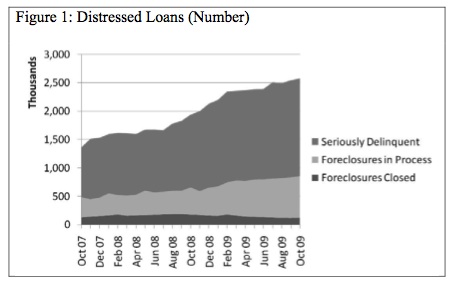

Cardiff Garcia has a post outlining the the economic impact of the foreclosure slowdown. I want to show this dated graph, where you can see that the foreclosure slowdown has been happening for a while now:

(Source.) The foreclosure slowdown is some mix of book valuation statistical juking (the banks don’t want to mark down the property and take the loss, and perhaps the property of the neighboring properties), pipeline limitations and a collapse of the new, ‘thin’ servicing model used by the largest banks. The foreclosure slowdown will likely increase as the result of servicing fraud, recordkeeping errors and the irresponsible practices for assembling mortgage-backed securities coming to light in the courts.

Garcia points us to recent remarks by Joseph S. Tracy, Executive Vice President of the Federal Reserve Bank of New York, at the Connecticut Business and Industry Association/MetroHartford Alliance Economic Summit and Outlook. Tracy has a specific worry about the foreclosure slowdown (my bold):

The combination of declining house prices and increasing delays in the foreclosure process will put upward pressure on default rates as well as losses on defaulted mortgages. CoreLogic estimates that in the third quarter of 2010 there were 10.8 million borrowers in negative equity where the balance on the mortgage exceeds the current value of the property…This increases the risk that these borrowers will default on their mortgages either out of necessity—say as the result of a job loss—or out of choice, which is called strategic default as borrowers determine that there is little economic advantage to keep paying the mortgage. Longer delays in the foreclosure process further increase the incentive for a borrower to strategically default by extending the period of time that they can live “rent free” in the house. In addition, declining house prices increase the expected losses on those mortgages that do default.

We should be worried about slowdowns in the foreclosure process because it will encourage people to default on their mortgages when they could otherwise afford to pay. Not that it exposes that the primary prestige industry in the United States over the past decade was a boiler room sham operation, but that people may start to really look at their debt obligations like a businessman.

Talk about a dog that didn’t bark in 2010. The funny part about this rhetorical crackdown is that there’s been no wave of strategic default people can point to. Homeowners really value their promises and are doing anything they can to try and do right by them, and the industry is using that leverage over them anyway they can.

There’s Been No Wave of Strategic Defaults.

You’ll sometimes hear the number that a third of defaults are strategic. That number comes a survey conducted by Luigi Guiso, Paola Sapienza and Luigi Zingales. They asked random people if they’d strategically default if their home was X% underwater, took their answers, and projected them onto the actual defaults and how underwater they were. There was no actual look at household budgets in creating this number. I’m a fan of Zingales’ writings, but this is simply not useful for the debate. There’s nothing here.

The Experian study from June, 2010 found that strategic defaults peaked in fourth quarter 2008. What’s a strategic default? “The research follows on an earlier report by Experian and Oliver Wyman that first aimed to quantify the share of mortgage defaults that are “strategic.” Strategic defaulters are defined as those who miss six straight mortgage payments without missing multiple payments on auto loans and other consumer debts for the six months after they first fell behind on mortgage payments.”

I don’t see that as a good working definition of strategic default. From their model a strategic defaulter is someone who misses six straight months of mortgage payments without missing multiple payments on auto loans and other consumer debts. It is fairly easy to keep consumer debt “current” by negatively amortizing it, or making the bare minimum payments. What is a legitimate default here? One where the person can’t make any payment on any of their bills.

All this definition means is that someone has enough money to pay their car payment and the minimum on their credit card but not enough money to pay their mortgage payment. The mortgage payment is going to be bigger than each of the other two, and there is no benefit to paying part of the mortgage payment, as it doesn’t keep it current. The definition you want is whether or not someone has income to make all their payments, not how they allocate payments.

It’s interesting that one of the few datapoints that find current (as opposed to 2008) strategic defaults, by CoreLogic, find them happening disproportionately among the rich, whose views on obligations probably mirror MBA and corporate logic more than community norms.

Borrowers Will Pay “A Substantial Premium”

Anyone actually looking at the data would conclude, in the words of the Federal Reserve Board: “The fact that many borrowers continue paying a substantial premium over market rents to keep their homes challenges traditional models of hyper-informed borrowers.” People take their obligations seriously, they (irrationally, in an economic sense) value their communities, neighbors and promises, and they work desperately to try and make good on them.

You can see this in the testimony of David Lowman, Chief Executive Officer, JPMorgan Chase Home Lending, at a House committee: “In fact, almost 64% of borrowers who are 30-59 days delinquent on a first lien serviced by Chase are current on their second lien. It is only at liquidation or property disposition that first lien investors have priority.” So what you see is a lot of people, over half, who have stopped paying their first mortgage trying to make some sort of payment. If people were economically informed, financially literate and strategic they’d not pay the second (especially if they can’t pay the first). But they want to be paying something.

Consider it from a debt point of view. The (back-end) DTI ratio of someone applying for HAMP is 77.5%, and is 61.3% after modification. Think about that. Here’s someone who spends 77.5% of their income servicing debt payments. To put that in perspective, this person will work until around October 10th in order to see the first dollar that doesn’t go to a creditor.

Instead of ditching this form of debt peonage, defaulting, going underground, etc. they are fighting to get into and through a program that will make it so they still spend the majority of their productive labor to pay off rentiers. Strategic default isn’t a binary on-or-off switch. You can have people putting the large majority of their productive labor towards debt payments and this is fine. And that’s what we see from people in the HAMP program.

With that in mind it’s almost shocking to see how little strategic default is going on. Wouldn’t it be great to have a system that met people trying to do the right thing halfway?

Joseph S. Tracey seems to be saying: “We should foreclose on people before they decide to stop paying their mortgages.”

Suggesting that the foreclosures be speeded up would seem to lead more quickly to eroding housing prices, leading to more people underwater, and more defaults. So what benefit does Mr. Tracey see to foreclosing more quickly, except to salve the banker’s indignation at folks living ‘rent-free’, as if the bankers are the only ones who ‘earn’ their keep and deserve hand-outs.

Treating shelter as widgets, applying Taylorism to maximize efficiency for profit. Externalizing the factory waste as homeless families and ravaged neighborhoods. The American Way.

The way he parses it, we are not individual actors, but an aggregate. The bankers don’t see their job as a utility to meet community needs for capital allocation, but rather as a polluting industry, maximizing their own profits, no matter the effect on society.

Mike,

I’m sure you saw this NY Times article “Real Estate Developers Prosper Despite Defaults” http://www.nytimes.com/2011/01/02/realestate/02developers.html

Norm asymmetry is a very good term (“I am determined, you are stubborn, he is a pain in the neck”). I do have the same feeling as the more celebrated David Petraeus in a different context – “tell me how this ends.” If 70% of Nevada homes are underwater, then you have a state that people can’t afford to move around in, or out of. Parts of Florida and California have to be in the same boat (excuse mixed metaphors – boats, underwater, etc. Maybe it’s a very leaky boat).

The probability of a lost decade has to be very high, with a lot of debt peonage and job insecurity. I hope the Japanese saved the lectures US policymakers and financial types favored them with in the 1990s.

Good post. I have been surprised by the relatively low percentage of people who default on their mortgages even when they can afford to pay them. It seems like it would be a common phenomenon but I wonder if a couple of factors might be at play: 1) people often think their homes are worth more than they are and 2) the foreclosure process is such a nightmare that it is not so simple as defaulting and then trying to buy back your house at a discount or whatever. I would like to know the actual percentage of mortgages that are defaulted on because the loan is non-recourse. – Adrian Meli

Pingback: FT Alphaville » Further further reading

“”In fact, almost 64% of borrowers who are 30-59 days delinquent on a first lien serviced by Chase are current on their second lien. It is only at liquidation or property disposition that first lien investors have priority.” So what you see is a lot of people, over half, who have stopped paying their first mortgage trying to make some sort of payment. If people were economically informed, financially literate and strategic they’d not pay the second (especially if they can’t pay the first). But they want to be paying something.”

He does not define second lien. If it is a HELOC then it is treated as revolving credit on credit score calculation. The borrowers are actually trying to keep their credit rating up, because they believe that paying the heloc offsets the reported mtg defaults and will keep their credit card limits and rates at whatever they currently are (now the universal default practice is banned ISTR anyway). Dinging the revolving credit part of your credit score also affects car ins rates, car loan access etc. Whether they (borrowers) are correct in this assumption of how credit scores works depends on how Fair Isaac computes the FICO score at any instant (we know they tweak and tune) and I don’t believe they (Fair Isaac) are telling anybody and certainly not the dumb debt slaves. But they are willing to bet, since they seem to keep paying. This (paying heloc to maintain credit score) was definitely occuring in 2008, 2009 and was fairly widely reported (lol, yeah I know you want a source but I am lazy and out of time, and it does fit with how borrowers might be expected to behave if they hear helocs are like c/cards).

Wow, people really are clueless. No one’s “doing right” by themselves, their families, their communities, or the country by continuing to pay these gangsters. The only right form of action is whatever action helps bring about the destruction of the finance tyranny. That means everyone should stop paying.

To think otherwise is a false economy, to put it mildly. And still wanting to honor a “promise” into which a con man fraudulently induced one is a false morality.

BTW, there’s no such thing as a “strategic default” among the non-rich. Since the banksters and federal government destroyed the real economy and will continue to permanently destroy real jobs until there are none left (this is their conscious, intentional policy), no one who’s not rich can vouch for his economic situation even a few months from now. So no one who’s not rich can affirm with any certainty that he can “afford to pay the mortgage”.

Pingback: DC Puts Its Bankster-Friendly Solution for Foreclosure Fraud on the Table « naked capitalism

Well I, for one, support the elites’ reinstatement of debtors’ prisons and that-there “accountability.” Damn straight. The banks and corporations should be held accountable for their debts. No more entitlements! No more strategic defaults! They’re gonna stop using Food Stamps on Wall Street, by golly. And the first varmint that uses economic modeling to see that defaulting is better than paying just ‘cuz they’re “underwater” on some investment is gonna be treated accordingly, as an example to the others.

“Hold people accountable when they do imprudent things.” THAT’S HILARIOUS.

“Here’s someone who spends 77.5% of their income servicing debt payments. To put that in perspective, this person will work until around October 10th in order to see the first dollar that doesn’t go to a creditor.”

At least until he decides that paying off his debts is a chumps game, after all everyone else is getting their free money – Wall Street, Congress, the “99ers”, the neighbour/friend/relative/dude who is “strategically defaulting”, and throws in the towel and defaults. As housing continues to fall in value, the dam WILL break eventually. Get ready for it.

Pingback: Plotting the course for a Second Bailout : Deadline Live With Jack Blood

I love the sound of jingle-mail in the morning.

Default en masse is an entirely appropriate retaliation for industry-standard practices like robo-signing and ninja-loans. Institutional investors need to be reminded that every single TBTF institution is as systemically dangerous as ever, to the point that no one will even want to be counterparty to any default swaps with them. The coup de grace will be the closing of the Fed window due to US sovereign debt default. May the zombie banks finally rest in peace.

The free market will cull the sectors of the financial industry that have outlived their usefulness. We owe no sentimental loyalty to that industry. Those millions in finance, insurance and real estate should have acted as prudently as they expected their clients to act: scrimp and save for a rainy day and not lived beyond their means in preparation for this inevitable day of reckoning. Our children will grow up in a new world where people trade goods and services instead of promises and numbers.

Pingback: « Strategic Default FDCPA.net

What Flavius said. Eloquently stated. When you think about it, these folks who are “strategically defaulting” on their houses early in this mess are performing a patriotic duty by enforcing market forces–before the price of collapse is even higher. Why indeed should they be enablers for the people who made the real mistakes?

“A new world where people trade goods and services instead of promises and numbers.” This view can only win, based on a natural law that debt has to be written off periodically, in all civilizations that survive. Read Michael Hudson, the economist in St. Louis, on this; it’s mind-blowing stuff on Hammurabi and Ancient Babylon, the Jubilee Year, and the fall of the Roman Empire. Hint: It wasn’t because of “Barbarians” or “Lead Pipes.” Remember the feudal system? What was it, except for debt servitude?

Basically, the “Magic of Compount Interest” is a math model that doesn’t exist in nature. Economies rise and fall, but they never grow at compound rates — at least not for very long. Meanwhile, their debt does. A certain amount of that has to be written off, and the higher up the curve you go, the riskier it gets. What happens at the end of that cycle is a crossroads: Either the lower class wins “free” credit through default, or the upper class digs in and enforces indentured servitude.

Pingback: Around The Dial – Jan. 19

Pingback: Five Points on that New Anti-Settlement Paper by Calomiris, Higgins and Mason. « Rortybomb

Pingback: Counterparties: DeMarco’s principal principle | Felix Salmon