[Mike here. Friends of the blog Josh Mason, of the blog slackwire, and Arjun Jayadev, former Roosevelt Institute fellow and economist at Umass-Boston, have an interesting new paper out on the growth of household debt over the past 30 years. I asked them if they would write a summary of this research that I could post here, and Josh was willing. Hope you check it out.]

Changes in debt-income ratios can be attributed to primary borrowing, interest rates, growth, and inflation. In a new working paper, we apply such a decomposition to the evolution of U.S. household debt. This shows that changes in borrowing behavior has played a smaller role in the growth of household leverage than is widely believed. Rather, most of the increase can be explained in terms of “Fisher dynamics” — the mechanical result of higher interest rates and lower inflation after 1980. Bringing leverage back down will similarly require contributions from factors other than reduced borrowing.

It’s a well-known fact that household debt has exploded in recent decades, rising from 50 percent of GDP in 1980 to over 100 percent on the eve of the Great Recession. It’s also well-known that household borrowing has increased sharply over this period. Indeed, for most people — including many economists — these are two ways of saying the same thing. In fact, though, they are quite different claims, and while the first one is certainly true, the second is not.

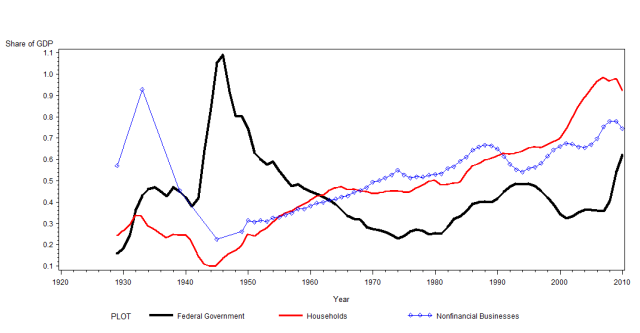

How can debt have increased if borrowing hasn’t? Though this seems counterintuitive, the answer is simple. We’re not interested in debt per se, but in leverage, defined as the ratio of a sector’s or unit’s debt to its income (or net worth). This ratio can go up because the numerator rises, or because the denominator falls. Household leverage increased sharply, for instance, in 1930 and 1931 (see Figure 1) but people weren’t were consuming more in the Depression; leverage rose because incomes and prices were falling faster than households could pay down debt. Similarly, changes in interest rates can change the debt burden without any shift in household consumption, because a level of spending that would be compatible with a stable debt-income ratio when interest rates are low will lead to a rising ratio when interest rates are higher.

Figure 1:

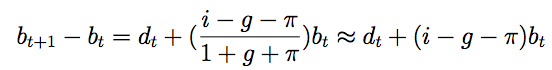

The role of interest rates, growth and inflation in shifting debt levels independent of borrowing is well-known when it comes to public debt. Indeed, “the least controversial equation in macroeconomics” (Hall and Sargent, 2011) is the law of motion of government debt:

where b is the ratio of debt to GDP, d is the primary deficit, again as a share of GDP, i is the nominal interest rate, g is the real growth rate of GDP, and pi is inflation. As this equation makes clear, a rise in interest rates or a fall in GDP can lead to a rising debt ratio, even if a government holds the line on spending and taxes; conversely, a government that runs deficits can still reduce debt via inflation as long as nominal interest rates remain low, as was the case in the US and most other rich countries following World War II. (Abbas et al., 2011) Indeed, as Willem Buiter and others have pointed out, the entire 90-point fall in the US debt-GDP ratio in the decades after World War II can be attributed to nominal interest rate below nominal growth rates; in the aggregate the US ran budget deficits over this period.

These dynamics are familiar when it comes to public debt. As a matter of accounting, the same equation applies to household and business debt as well. But strangely, despite the example of the Depression (and Irving Fisher’s famous diagnosis of rising debt burdens caused by falling prices and incomes (Fisher 1933)), no one has systematically examined what fraction of changes in private debt can be attributed to changes in interest, growth, inflation and new borrowing. [1] In a new paper, Arjun Jayadev and I attempt to fill this gap, applying the standard decomposition of public sector debt changes to household debt in the United States for the period 1929-2011. (Mason and Jayadev, 2012.) Our findings challenge the conventional narrative about rising household debt.

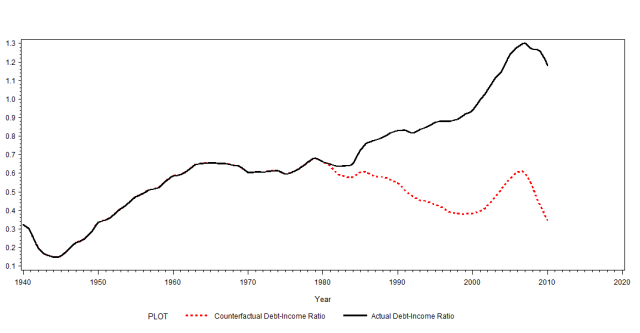

What we find is that the entire increase in household leverage after 1980 can be attributed to the non-borrowing components of the equation above — what we call Fisher dynamics. If interest rates, growth and inflation over 1981-2011 had remained at their average levels of the previous 30 years, then the exact same spending decisions by households would have resulted in a debt-to-income ratio in 2010 below that of 1980, as shown in Figure 2. The 1980s, in particular, were a kind of slow-motion debt-deflation, or debt-disinflation; the entire growth in debt relative to earlier periods (17 percent of household income, compared with just 3 percent in the 1970s) is due to the slower growth in nominal income as a result of falling inflation. In other words, there is no reason to think that aggregate household borrowing behavior changed after 1980; indeed households rescued their borrowing in the face of higher interest rates just as one would expect rational agents to. The problem is that they didn’t, or couldn’t, reduce borrowing fast enough to make up for the fact that after the Volcker disinflation, leverage was no longer being eroded by rising prices. In this respect, the rise in debt-income ratios in the 1980s is parallel to that of 1929-1931.

Figure 2:

Think of it this way: If you borrow money and your income in dollars rises by 10 percent a year (3 percent real growth, say, and 7 percent inflation) then you will find it much easier to pay off the debt when it comes due. But if you borrow the same amount and your dollar income turns out to rise at only 4 percent a year (the same real growth but only 1 percent inflation) then the payment, when it comes due, will be a larger fraction of your income. That, not increased household spending, is why debt ratios rose in the 1980s.

Neither the 1980s nor the 1990s saw an increase in new household borrowing — on the contrary, the household sector in the aggregate showed a primary surplus in these decades, in contrast with the primary deficits of the postwar decades. So both the conservative theory explaining increased household borrowing in terms of shorter time horizons and a general lack of self-control, and the liberal theory explaining it in terms of efforts by those further down the income ladder to maintain consumption standards in the face of a falling share of income, need some rethinking. Given the increased availability of credit and rising inequality, some households may well have chosen to increase spending relative to income, and those lower down the income ladder presumably did rely on borrowing to maintain consumption standards in the face of stagnant wages. But for the household sector in the aggregate, until 2000, there is no increased household borrowing to explain.

The main results are summarized in Table 1, which shows the average contribution of each of the terms from equation 1 to the annual change in household leverage over seven periods. Positive numbers indicate factors that raised leverage, while negative numbers are factors that reduced it.

Table 1

| Period | ∆b | d | i | g | π |

| 1929 to 1933 | 0.025 | -0.049 | 0.024 | 0.023 | 0.023 |

| 1934 to 1945 | -0.021 | -0.010 | 0.019 | -0.025 | -0.008 |

| 1946 to 1964 | 0.028 | 0.023 | 0.031 | -0.017 | -0.009 |

| 1965 to 1980 | -0.001 | 0.008 | 0.055 | -0.027 | -0.038 |

| 1981 to 1999 | 0.014 | -0.015 | 0.081 | -0.025 | -0.025 |

| 2000 to 2006 | 0.050 | 0.033 | 0.080 | -0.038 | -0.025 |

| 2007 to 2010 | -0.020 | -0.067 | 0.079 | -0.006 | -0.026 |

In this table, i, g and pi represent the contributions of those three terms to the change in leverage — that is, the underlying value times the debt-income ratio at the start of the year. This is why the contribution of interest remains so much higher in the 2000s than before 1980, even though interest rates had fallen back down to their pre-Volcker levels by then. As can be seen from the table, leverage rose in the 1980s and 1990s after being stable in the previous 15 years, but the difference was not higher household borrowing; rather, the whole difference is explained by higher interest costs and slower inflation.

An important point to note in Table 1 that in the period of the housing bubble — 2000 to 2006 — the conventional story is right: during this period, the household sector did run very large primary deficits (averaging 3.3 percent of income), which explain the bulk of increased leverage over this period. But not all of it: even in this period, about a third of the increase in debt was due to the mechanical effects of i, g and pi. And in the following four years, households reduced consumption relative to income [2] by nearly as much as they increased it in the bubble years. But these large primary surpluses barely offset the large gap between interest and (very low) growth and inflation over these four years. In the absence of the headwind created by adverse debt dynamics, the increase in household leverage in the bubble would have been effectively reversed by 2011.

We draw two main conclusions. First, as a historical matter, you cannot understand the changes in private sector leverage over the 20th century without explicitly accounting for debt dynamics. The tendency to treat changes in debt ratios as necessarily the result in changes in borrowing behavior obscures the most important factors in the evolution of leverage. Second, going forward, it seems unlikely that households can sustain large enough primary deficits to reduce or even stabilize leverage. Even the very large surpluses of 2006-2011 would not have brought down leverage at all in the absence of the upsurge in defaults; and in the absence of large federal deficits and an improving trade balance the outcome would have been even worse since reductions in household expenditure would have reduced aggregate income. As a practical matter, it seems clear that, just as the rise in leverage was not the result of more borrowing, any reduction in leverage will not come about through less borrowing. To substantially reduce household debt will require some combination of financial repression to hold interest rates below growth rates for an extended period, and larger-scale and more systematic debt write-downs.

[1] Growing interest in leverage has led to various qualitative attempts along these lines, such as Roxburgh et al. (2010) But to our knowledge no one has applied Equation 1 to private sector debt, as we do.

[2] While the Flow of Funds show households paying down debt at an average rate of nearly 7 percent of income annually between 2007 and 2010, as reflected in Table 1, nearly half — 3 percent — of that is actually accounted for by defaults rather than reduced borrowing.

References:

Abbas, S. M. A., N. Belhocine, A. ElGanainy, and M. Horton (2011): “Historical Patterns of Public Debt Evidence From a New Database.”

Fisher, I. (1933): “The Debt-Deflation Theory of Great Depressions,” Econometrica, 1(4), pp. 337–357.

Hall, G. J., and T. J. Sargent (2011): “Interest Rate Risk and Other Determinants of Post-WWII US Government Debt/GDP Dynamics,” American Economic Journal: Macroeconomics, 3(3), 192–214.

Roxburgh, C., S. Lund, T. Wimmer, E. Amar. C. Atkins. J. Kwek, R. Dobbs and J. Manyika (2010). “Debt and Deleveraging: The Global Credit Bubble and Its Economic Consequences.” McKinsey Global Institute.

Am I correct that inflation (so long as it’s positive) and growth (so long as it’s positive) will always give a negative number in Table 1 so that what we’re interested in is the relative size in the different time periods?

And in Table 1, is i + pi = the real interest rate effect on household debt? In the 1965-1980 period this increases debt by 1.7% per year (if I’m understanding the numbers correctly) where as in the 1981-1999 period it increases it by 5.6% per year. That’s what you’re saying is the big difference, right?

I was surprised that there wasn’t a bigger difference in the two time periods in g (which is the growth rate of household income, right?). Why was g so high (in absolute value) in 2000-2006 and so low in the 1946-1964 period? I would have thought it would be opposite. Do I have the numbers backward in my head?

Looks like really interesting and useful research. Certainly not something I knew about.

Pingback: Household Debt and the Real Interest Rate | liamcmalloy

Hi Liam,

Thanks. I’m sorry, the table is a little confusing. The d, i, g and pi in the table refer to the contributions to debt from each variable and not the value of the variable itself (the contributions dont add up to 1 since there is an interaction term that is not shown).

Arjun

I should probably just read the paper. It looks interesting.

fwiw, i’ve left a very long comment on this over at slackwire. i comment on the paper, focusing on Figure 6, but that figure graphs the stylized facts presented here in Table 1 and the discussion.

Pingback: American Households Not as Reckless as You Think | The Militant Left

Pingback: The Dynamics of Household Debt - The Coming Depression | The Coming Depression

When possible please do continue to explain the conclusion, which which I agree, on Mark Thoma’s blog. A terrific article.

While the breakdown of debt across these components is fascinating, it seems like there is an odd assumption made in characterizing consumer borrowing behavior as “unchanged” during the disinflationary period of the last 25 years: namely, that consumers think in absolute and not relative terms when thinking about debt. When prices (wages) are rising 10% per year, as they were around 1980, a consumer’s ability to service debt is rising about 10% per year. Consumers who take advantage of that increased (nominal) debt capacity (from increased nominal wealth) to borrow more are acting in a particular way that is fairly easy to understand. As inflation fell towards zero over ensuing years, we would expect consumers acting in a similar way to stop increasing their debt so rapidly. Yet that is not at all what they did – they continued to pile up debt at a rapid clip, far outstripping the rise in their incomes. This seems like a significant break from previous habits and not a benign “Fisher effect” as the authors seem to claim. A more plausible story seems to center on the effects of falling interest rates on debt service burdens, allowing debt to be accumulated without a corresponding increase in current outlays (until rates hit zero, that is).

Well, more precisely, we would expect them to reduce their expenditure (or new borrowing) relative to their income. And they did! Quite a lot, actually. The error that we are trying to correct here is the idea that *debt-income ratios* are a decision variable for households. It is not the case that households “continued to oile up debt at a rapid clip” (until 2000-2006, when they did indeed.) What actually happened is that households sharply reduced expenditure relative to income, but not fast enough to overcome the effect of slower nominal income growth and the compounding growth of interest payments.

Another error we are trying to correct is the assumption that low interest -> high debt, and conversely. This is of course true in a conventional model where economic actors are assumed to know the entire future path of income and interest rates before making any choice about expenditure. but in the real world, where units that already carry debt can be surprised by changes in interest rates, an increase in interest rates has two contradictory effects. On the one hand, it aces new borrowing less attractive at the margin. but on the other hand, it increases the cost of servicing (& rolling over) existing debt. There’s no a priori way o knowing which of these effects will dominate even for rational households — it depends how easy it is to rapidly adjust consumption, and how large the debt is to begin with.

Pingback: Debt and Regret: Inflation Edition « Modeled Behavior

Pingback: Brunch Links: 2-24-2012 | Modern Monetary Realism

Interested to know how are you calculating d (primary surplus/deficit)– is it the yoy change in (financial assets-financial obligations as a % of disposable personal income). The rise in asset prices might make any level of borrowing sustainable and hence this impact might show up through other variables such as i,g, and inflation. The personal savings rate has been coming down through the last three decades– this seems to be indicating a change in the behavior of households.

Thanks.

Regards, Sonal

Sonal,

Good question. The primary deficit d is calculated as net borrowing minus interest payments — or in other words new funds flowing to households from the credit markets –, divided by disposable income (DPI) adjusted for the anomalous treatment of housing. This is equivalent to consumption plus net acquisition of financial assets minus DPI, divided by DPI. So changes in asset values don’t affect d at all.

People do sometimes talk about leverage with net worth rather than income in the denominator; when we extend the analysis to nonfinancal businesses we will probably use this definition. In that case, fluctuations in asset values will affect leverage ratios. But in the definition used here they do not.

(The housing adjustment is necessary because the NIPAs consider a home-owning household to be running an incorporated business renting to itself, so it adds both an imputed stream of rental income to the income side and an imputed rental payments to the expenditure side. This does not make sense for our purposes, so we remove both of these imputations, and treat housing purchases as consumption just like purchases of any other durable good.)

incorporated s/b unincorporated.

Pingback: Household Debt and Deleveraging

Thanks a lot. When we talk about primary deficits for governments, interest payments are excluded as they are part of the interest*b@(t) calculation. But in your calculation, you include interest payments by households in the primary deficit(surplus) calculation. I think that makes surplus numbers look higher (or turn a deficit into surplus as the case may be) in the 1980s and 1990s, and deficit numbers look less alarming in early 2000s. Is that the right way to think about it and if so, how would that change the results of your study. Thanks.

Regards, Sonal

So the Fed is the main culprit, for holding inflation at too low a level?

And what about the behavior of lenders, after 2000? They were falling all over themselves to make loans. “When banks compete . . .” as the ad said. Whatever happened to that ad? 😉 The whole housing bubble was in large part the result of reckless, even criminal lending.

Pingback: interfluidity » Persnickety followups on inequality and demand