A lot of people are talking about the death of so-called “free” checking that could be in the works at Bank of America. Here’s Kevin Drum and Felix Salmon writing about this. Felix also mentions interchange and credit unions in his post.

A few things, and then two comments I want to get at. First off, and Adam Levitin beat me to it, is that you almost certainly don’t have free checking. What you have is a monthly fee that is waived if you do certain things. See BoA here. Unless you are a student at that page, you don’t get free checking, you get a monthly fee waived if you direct deposit and/or hold a minimum balance. There was the story that was going around in February about how the recently unemployed were realizing that their “free” checking had been turned off because they no longer had any income to direct deposit. Which is to say, it was free until it wasn’t.

Spruiell

When I was writing about Tim Lee’s thoughts on interchange, I was going to joke that maybe he likes the regressive tax because he views himself as a positive externality, and the poor and risky as a type of pollution, and that it’s optimal to have a system setup that punishes and disciplines the poor in order to reward people like himself. Markets not as a means for allocation or empowerment or broad-based participation, but markets as a form of control and abuse towards the weakest for the benefit of the strongest. But I didn’t because I doubt he believes that and I didn’t want to make him sound that way.

And I was sure someone would make that point for real. Here’s Stephen Spruiell with ‘Consumer Financial Protection’ in Action:

The old model: Banks use high fees on avoidable behaviors that are nevertheless common among the financially inept, such as account overdrafts, to subsidize free checking accounts and other reward programs for customers who use their accounts responsibly.

The new model: Liberals argue that overdraft fees are abusive and should be banned. Democrats enact new restrictions on overdraft fees. Banks end free checking accounts and other reward programs for responsible customers.

“Inept.” First off, I highly doubt Spruiell has seriously read all his consumer financial contracts and understood them completely. Second, I do like the way that he basks in the subsidy. When I was at GMU discussing credit cards with some people, someone mentioned liking the idea that inside his wallet were 3 cards all competing for his attention at the store. Stephen apparently really likes the idea that inside his wallet his debit card is smacking around poor people until they get with it.

Third, people say all kinds of things, but most reformers I know on this issue just want people to be able to opt-out of this service. And that’s what the regulation did. And sure enough, BoA is canceling it, presumably because most would opt-out. That’s not a government problem, that’s a problem that BoA had a product nobody wanted but people needed the checking account and financial services access bundled with it.

FDIC Study

Here’s Katherine Mangu-Ward, Pizza, Long-Distance Calls, and the End of Free Checking: “Overdraft fees minimized the losses on the smallest accounts. Now those costs will be spread evenly across people who don’t have very much money in the bank.”

I’m not sure what that statement means. I think it means that the rich were paying a little bit extra in order to expand banking services to the poorest (“smallest”) accounts. If so, that’s not true.

Let’s pull some data on overdraft from FDIC’s Study of Bank Overdraft Programs, November 2008. NSF stands for Non-sufficient funds, which is an overdraft. This is one of many fees you can get charged. On average across all counties that the following study was carried out on, the upper bound for low income bracket is $29,263, medium is $46,821, middle is $70,231 and upper is above that.

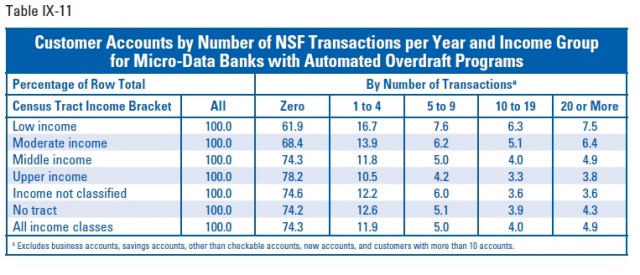

First question: Who gets hit with the most fees, and how many NSF fee events do they have?

For low income people, 61.9% don’t have any fees. 7.5% have 20 or more fees. As people have more money, they are less likely to get hit by NSF fees in every grouping of transactions. But how much do they end up paying over the course of a year, on average?

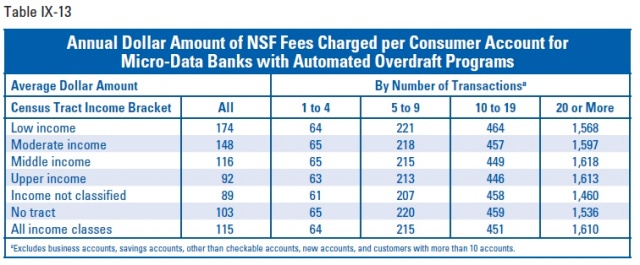

You are reading that right. From the first graph, 7.5% of low income people, who make less than $30,000 a year, get hit with 20 or more NSF fees for an average total cost of $1,568. Thank god they didn’t have to pay an upfront fee however!

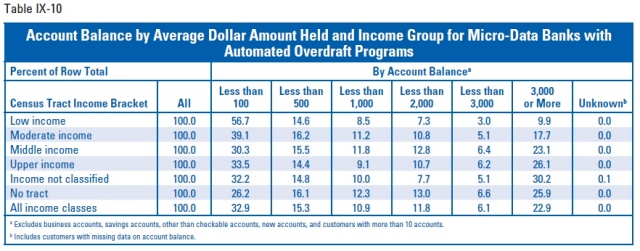

What’s important is that the rich pay more or less the same in fees as the poor, but the poor are more likely to pay them. Spruiell believes these fees are from being “inept.” Let’s take a look at checking balances, on average, through the year:

For low-income people, 56.7% have less than $100 in their checking account when averaged throughout the year. Some will pay $1,568 in order to get a space in the connected economy in order to productive use a balance of $100. Of course someone in these circumstances get hit with overdraft fees, especially if they are getting bombarded with a dozen other fees at the same time.

What’s going on with the numerous NSF among the upper and middle income? Part of it might be “inept”, though I think in practice it’s probably a function of the sweat box mechanism of how consumer credit goes. Bankruptcy has been reengineered, post-2004, to get consumers to have a long, slow drawdown before they are eligible for bankruptcy. This piles on fees, and gives the household more time to see if they can recovery I suppose, but the final product is a slow bleed of their finances through things like banking fees.

The overall reason, however, is that banks used to have a trust element to them, and now it’s a vicious rip-the-face-off-the-customer experience. You can argue that you should expect to be ripped off, that it should be your full-time job to guard your money from the bank who is holding it. As my friends at bank simple put it: “I’ve already got a full-time job, and it should be the bank who looks after my money. That’s what banks are for. At least, that’s what they used to be for.” Somehow we lost the default social norms that kept this a healthy relationship. And things that can make how these funding mechanism are more transparent the better off people will be.

The overall reason, however, is that banks used to have a trust element to them, and now it’s a vicious rip-the-face-off-the-customer experience.

Business plans that relied on long-term relationships with customers and building up a corporate reputation for quality and service seem to be dying throughout the business world, replaced with ripping the customer’s face off as fast as possible.

Maybe that’s an efficient competitive outcome, but if so, I’d like the inefficient model back.

I think what Katherine Mangu-Ward was trying to say not that upper income earners were paying more in bank fees, but instead that the banks were already making money (interest) off of those with high balances. The banks don’t make much in interest on the low balance accounts, so they make up for it in NSF fees. Not that I agree, but I think that’s her point.

Is it impossible to find out what percentage of people with free checking accounts are low income earners? I’d like to know how many low income or moderately low income earners have been or are going to be affected by the new checking account fees (do or will have to pay a monthly fee because they do not meet the requirements to maintain a “free” checking account). Thanks.